Widely regarded as an indicator of industry performance, The Big 5 2012 appeared to generate a greater buzz compared to the recent crisis years. Did this year’s turnout truly reflect the status of the industry, the market, and the economy as a whole? Jerome Sanchez brings the report.

Widely regarded as an indicator of industry performance, The Big 5 2012 appeared to generate a greater buzz compared to the recent crisis years. Did this year’s turnout truly reflect the status of the industry, the market, and the economy as a whole? Jerome Sanchez brings the report.

This year’s Big 5 hosted more than 2,500 exhibitors from 60 countries, and drew more than 36,000 visitors over the course of four days, according to the event organisers.

Apart from the annual exhibition, visitors and participants attended the free seminars covering various topics, LEED seminars on sustainability, as also live product demonstrations. In addition, Middle East Concrete, PMV Live and FM EXPO were held simultaneously at the venue, giving the exhibition-goers a complete range of products and services under one roof.

The Big 5 Show 2012 was officially inaugurated by H.H. Sheikh Maktoum Bin Mohammed Bin Rashid Al Maktoum, Deputy Ruler of Dubai. Other dignitaries and personalities were also present at the event, among whom was David Cameron, the Prime Minister of the UK, who visited the UK Pavilion.

Many regard The Big 5 as the barometer for the industry and draw conclusions on its performance based on the number of visitors and participants at the event. Therefore, as another page in the more than 30-year history of The Big 5 Show unfolded, the questions in the minds of the visitors, participants, and industry players were: How would this year’s exhibition fare? Would we see an increase in the number of visitors and participants and an improvement in the quality of products and services on offer? Would the target visitors come and would it actualise into business deals for the exhibitors? Would the outcome of The Big 5 reflect the performance of Dubai’s economy? What other advantages would The Big 5 offer its participants?

IS BUSINESS PICKING UP?

Disappointed faces, low voices, terse responses and watered down smiles characterised the first day of this year’s show. A lot of industry players we spoke to seemed to accept the fact that the first day would generally be low-key. But they hoped that things would pick in the following days. “There are less people this year,” said Darius Khanloo, Managing Director at Hörmann Middle East. “It’s a little quiet on the first day.”

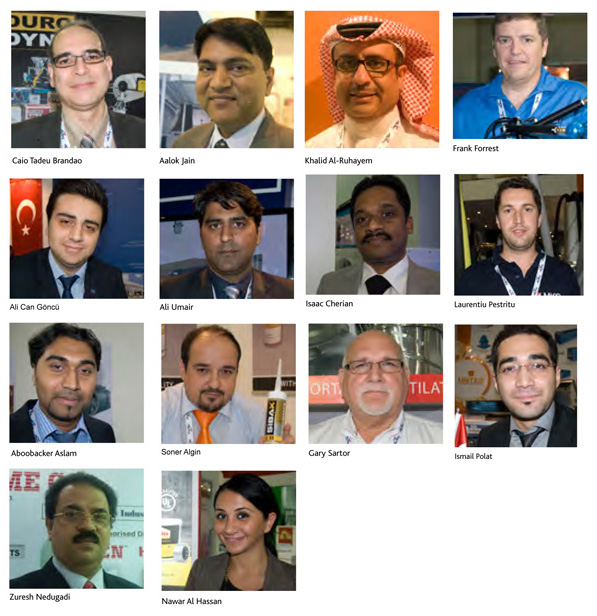

Aalok Jain, Sales Manager, Gulf Air-conditioning Manufacturing Industries (GAMI), added, “Our target visitors, contactors and consultants, are not yet coming.”

Business definitely picked up on the second and third days. While walking through the aisles of the different pavilions, one could definitely tell that companies were busy and that serious talks were going on. The event also saw the presence of bigwigs from different participating companies.

A majority of this year’s exhibitors observed an increase in the number of visitors and participants at the Show, compared to the previous editions. “I feel that this is a bigger exhibition,” said Khalid Al-Ruhayem, Marketing Manager, Afico. “This year is more organised, more countries are participating, and more companies are present.” His observation supported The Big 5 Event Director, Andy White’s declaration that this year’s exhibition saw a seven per cent increase in exhibitor participation compared to the previous year, making this year’s edition the largest show to date.

Caio Tadeu Brandao, Director of International Sales, was of the opinion that The Big 5 public was coming back after the recession and that there were more people compared to 2009 and 2010.

Mohammad Rasmi Saed, Sales Engineer, Huya Pre-insulated Duct Factory, added, “People from all over the world come here – from India, USA and Iran.”

Aside from the count, a number of industry players also noted an improvement in the quality of visitors at this year’s event. Many of them noticed a change in the market’s appreciation of the products and technologies showcased.

John Lipscomb, International Sales Manager at DuctSox, said that the visitors were now looking at high technology products with a much more open mind. “People didn’t accept new ideas before; now we are seeing that they are already beginning to accept [them],” he commented.

Added Isaac Cherian, Marketing Manager, End User and Retail Solutions, Emerson: “We have regular visitors coming in, and they are now interested in new technology.”

Jones Wu, Regional Manager for the Middle East Region, Gree, also made a similar observation, “The market is now asking for quality and more efficiency as people in the Middle East are getting more education in energy efficiency and climate change.”

Zuresh Nedungadi, Business Development Manager for Middle East and Asia, Prime Co Middle East, seconded this view when he said, “We are observing that quality is now the priority for the market and for MEP contractors, consultants, and traders.” This opinion was shared by some of the participants from Turkey, which was represented by a contingent of approximately 180 companies. They felt that this year’s visitors were more open to exploring other products and opportunities and willing to deal with new companies, apart from the more established and bigger players. “Customers are now looking for alternative companies; they are not looking only for big players anymore,” said Ali Can Göncü, Mechanical Engineer from Gonka. “Visitors from the GCC and other countries in Africa are approaching us now.” Though many companies shared this view, it was not unanimous. A few of them felt that the financial constraints plaguing the market have continued to dictate the priorities of the companies.

“The market is getting better, but it is still all about money,” declared Colin Hawkes, Managing Director, Apollo Insulation. “The best products are not always selected due to financial constraints.”

Ali Umair, Commercial Manager at Doby Verrolec, voiced his concerns about the issue of price versus quality when he said, “Increased competition has taken the focus away from quality to price.” He explained that the gap between the high-end and the low-end market was widening in recent years. While the high-end market, with construction projects such as palaces and government buildings, was more concerned about quality, the low-end market, including freehold properties, looked at price more than anything else. The problem, he said, was that the low-end market was widely outgrowing the high-end market, with the result that priority given to price over quality was becoming even more pronounced.

HOW DID THE BAROMETER READ?

The HVACR industry, which, in the GCC, is reported to be worth around US$ 6.4 billion, was still the biggest represented sector at the event. The sector is expected to see annual growth of around nine per cent over the next three years owing to a projected increase in construction projects across the region and a gradual resumption of ventures previously put on hold. Many companies welcomed this and the fact that new projects, albeit not as grand and ambitious as the ones in the past, were being initiated.

Did this year’s turnout reflect the reported prevailing condition of the economy of Dubai, and the GCC as a whole? Though Khanloo believed that the economy of Dubai was getting better, he declared, “I will never expect Dubai to become like before. I think Dubai will become more stable in the future, because Dubai and the companies have learned already. We never gave up on this market. We see positivity here and we see a strong potential in the Middle East.”

Other industry players hitched their optimism to their observation that Dubai is now taking a more sustainable and viable path to growth, thanks to the realisation brought about by the economic downturn. “There are indications that Dubai is a recovering market,” assessed Brandao. He believed that construction had not really stopped in Dubai but only became more “realistic” in the recent years. “We can now see a more controlled environment,” he added. This, in his opinion, meant that the more sensible projects, like hospitals, schools, and airport terminals were being prioritised over other projects. Saed shared Brandao’s view when he said, “It will take time; slow growth is the normal growth.”

“We can see a big improvement in construction in Dubai, particularly in the small to medium construction jobs,” said Pramodh Idicheria, General Manager, Leminar.

“Dubai, at this time is slow but steady,” added Aboobacker Aslam, Sales and Marketing Manager, Systemair. “Receivables are still there, but not as bad as before.”

Al-Ruhayem, driving home the point that stability in Dubai remains strong despite the hit it received from the crisis, said: “Companies go to Dubai to invest for more stability. The government here is stable, the country is stable and everything an investor needs is here in Dubai.”

Whilst most of the companies we spoke to expressed optimism and confidence about the present performance of the economy, some industry players articulated their reservations. “It may take another year for Dubai’s economy to come back,” noted Shrikant Navare, Managing Director, Systemair. In his opinion, one might see the real improvement in the economy from 2014 onwards. He added that, though new projects were being planned, he estimated that it would take two to three months for them to materialise.

Vijay Parikh, Sales and Marketing Manager, CMS, said that he was already sensing some growth in the market, but it was still too early to call. “There is more work to be done,” he said. “The realistic growth is slow and steady; the more important growth is a sustainable growth.”

DUBAI AND BEYOND

Despite the economic downturn that struck Dubai and the Middle East during the crisis years, many still believe in the advantage of opening and keeping businesses running in the region, as signs of recovery are gradually becoming discernible, and the status of Dubai as a hub for other markets remains unchallenged.

Soner Algin, Export Regional Manager, Siba, believed that despite the economic downturn, Dubai was akin to a port for different countries and was a strategic starting point for Turkey-based Siba. Saed, on his part, likened Dubai to a magnet and to a window to the world. Speaking about Siba’s participation at the Show, Algin said, “We are looking to expand our export business to Jordan, Libya, Egypt, Senegal, Ghana, Algeria, Tunisia, and the southwest part of Africa.”

In general, the participants we spoke to regarded their presence at The Big 5 Show as a stepping stone to opportunities in other countries. They were unanimous in their opinion that one salient benefit of being at The Big 5 was the exposure their companies got not only to Dubai-based visitors and participants but also to exhibition-goers present from all over the world. “Dubai remains the central business core, and the outlook here appears to be better,” declared Gary Sartor, National Sales Manager, Ventmatic, whose company regarded Dubai an excellent starting point for the introduction of its products to the rest of the Middle East. “We can see good signs of recovery, the energy is getting stronger and new construction projects are under way,” he added.

Nedungadi, explaining how exposure at The Big 5 was beneficial to Prime Co, said, “Dubai is an international market; we are looking at other places in the MENA region from Dubai.” He added that people from other Middle East countries, including Iraq, Iran and Jordan, had come to visit the exhibition right from day one.

Nawar Al Hassan, Assistant Brand Manager, Gulf Region, Adhesive Technologies, Henkel, said that introduction of his company’s new line of HVAC-related products at The Big 5, was met with huge client potentials. “This is our first year in the HVAC market, and The Big 5 is definitely a helpful avenue,” he said.

As Steven Gobert, Export and Marketing Manager of Belgium-based Grada, put it, “The Big 5 is a fantastic opportunity to meet people from different countries, such as Oman, Qatar, Bahrain and Egypt.”

Ismail Polat, Mechanical Engineer from Turkey-based Üntes, added: “Dubai is the trade centre in this area. Here we meet people from other Arabic countries, and Europeans are also here. We see a big potential in Dubai.”

Italy-based Tazzetti’s Business Director for Europe, North-East Africa and Middle East, in a communiqué, said: “Our company’s steady growth in North Africa and Middle East regions encouraged us to further expand our operations in the Middle East. We will enter new regional markets, and at the same time strengthen operations in existing ones. Our sales organisation and partnerships with professional distributors will help us effectively implement our business in the GCC markets.

IN CONCLUSION …

Confident smiles, friendly faces and relieved expressions greeted us on the fourth and last day of The Big 5 Show 2012. Most of the participants we spoke to were happy with this year’s performance. In general, there was a return of optimism, and the opinion that the industry was slowly regaining its fighting form was almost unanimous. Most of the exhibitors spoke about deals and agreements signed or closed during the Show, which, according to them, was a testament to the slow, but steady revival of the market.

Through the years, The Big 5 has served as an avenue for regional and international companies to come together, meet their clients, showcase their products, gauge the market and, most importantly, explore possibilities of cooperation and synergy in the future. This year was no different.

Overall, the 2012 edition was observed to be better than the previous years. What was heralded to be “the biggest Big 5 Show to date”, in a way, lived up to its expectations. For many participants who shared their views with us, the cloud of crisis hovering over Dubai, the GCC, and the world over, has cleared. Though still a little hazy, the path to recovery and revival can now be perceived.

For most of the exhibitors, however, the fact that Dubai and the GCC were already on their way to recovery was no longer the most vital question. What was more critical, in their opinion, was how the next phase of growth could be sustained.

It’s showtime!The Big 5 Show 2012 provided an opportunity for companies to showcase their latest products and concepts to the visitors and fellow-participants. Here is a sample of what was on display… John Lipscomb, DuctSox, spoke about Skelecore. Regarded as DuctSox’s solution to fabric duct droop, Skelecore is claimed to maximise the open shape of a fabric duct while it is in a deflated mode, thus allowing for smoother and quieter inflation upon equipment start up. Presenting its salient features, Lipscomb said: “This product is lighter in weight, easier to install, easier to take down and wash, of hygienic quality, energy efficient, provides better dispersion of air and is considered a green product.” Pramodh Idicheria, General Manager, and Kartik Raval, Divisional Manager, Air Conditioning Equipment, Leminar, presented their latest Rheem condensing units. Raval explained that the condensing units had the lowest power consumption, high efficiency and much bigger condensing coils, helping them work even at high ambient temperatures. He added that the condensing units use R410A and has a seasonal energy efficient ratio of 13. “Cork is a very good material for thermal, acoustic and vibration insulation,” claimed Carlos Manuel, General Manager, Amorim Isolamentos, presenting the advantages cork could provide. “It is more expensive, but it is the most sustainable [material], it comes without additives, has long durability and can survive in high temperatures and still keep its original dimensions and durability.” Darius Khanloo from Hörmann showed us thermal insulation doors, inflatable dock shelter and dock leveler. He demonstrated how they operate, saying, “These products would ensure that food cold chain is maintained all throughout the process of unloading.” He pointed out that the technology involves an inflatable sock shelter that covers, as much as possible, all open points between the AC-cooled warehouse and the outside. With the use of the leveler, on the other hand, Khanloo explained that the load could be moved in or out of the lorry in a single horizontal movement. Arun Tuli, Managing Director, Mekar, presented Mekar’s patented Ozone System, explaining that it finds applications in several fields, including hospitals, laboratories, and schools. Tuli claimed that the system ensured the microbiological safety of indoor air, water and surfaces. The Double Box, as described by Mekar, attacks, oxidises and inactivates various organic compounds, including mites, bacteria, fungi, moulds and viruses. In addition, the Double Box reduces undesirable odours and reduces the cost and work needed to sanitise rooms. “Our insulation board has many advantages,” said Mohammad Rasmi Saed of Huya, showing a sample of the thermal insulation board. He enumerated a few of its advantages: “It’s anti-bacterial, corrosion- resistant, fire-retardant, and CFC-free.” In addition he also mentioned that the product, made in the KSA, was easy to fabricate, install, maintain and transport and complied with European standards. Apollo Insulation introduced several of its products at The Big 5 Show, including Eco-Brite, Thermo-Foil and InsuFlect. Colin Hawkes spoke about Thermo-Foil, a two-sided single foil for use as a heat reflective liner in domestic, commercial and industrial buildings. He highlighted that Thermo-Foil would reflect 96.7% of infrared energy and could minimise energy needs and improve comfort for occupants. Tested against UV rays and humidity, Hawkes claimed that the product could stand undamaged for 30 years or longer. Kenny Geng and Jones Wu from Gree introduced their GMV system. Saying that the system could save energy by 40% to 60%, Geng explained that one outdoor unit could be used with up to 80 indoor units. He further mentioned that each individual unit could be controlled to ensure the comfort of the area’s occupants. Wu revealed that Gree was the first Chinese manufacturer with ESMA certification, and that it had the capability as well as the responsibility to provide the best quality products to the market. Shawki Shahhoud, Regional Manager, Dubai Representative Office, Uponor, spoke about the Thermally Active Building (TAB) Systems. He claimed that it utilises the concrete’s thermal mass by embedding pipes carrying water for heating and cooling in the building’s structure. Though not a substitute for a ventilation system, TAB contributes to ensuring the best possible indoor environment and reduces the load of conventional heating and cooling technologies to a minimum. |

Copyright © 2006-2025 - CPI Industry. All rights reserved.