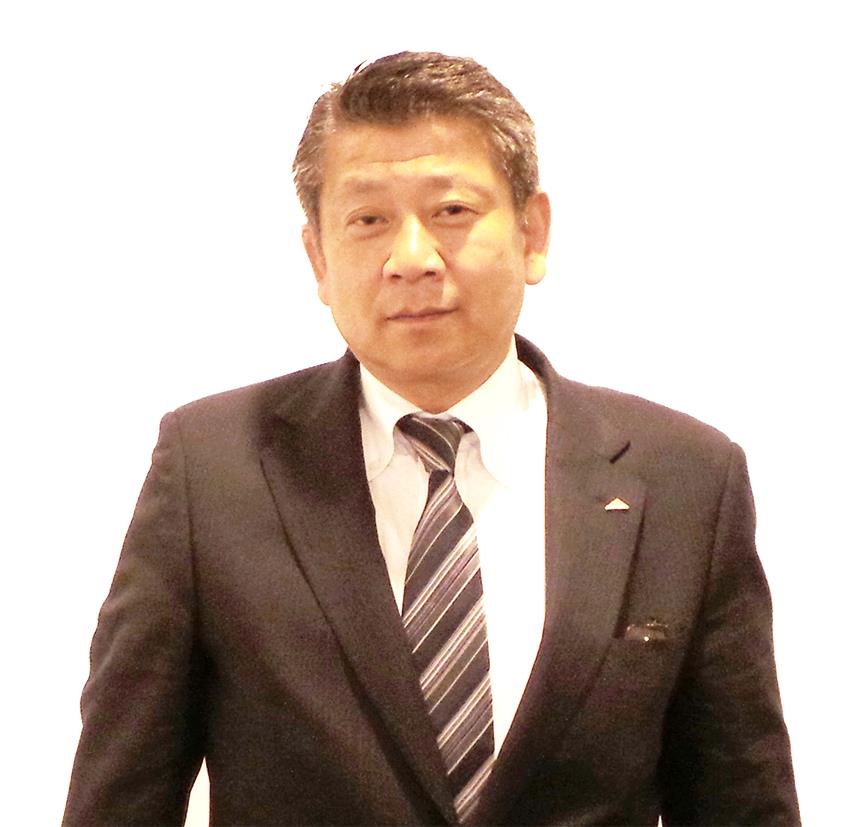

Ryouji Sanou, President of Daikin Middle East and Africa, sits down with Fatima de la Cerna of Climate Control Middle East to discuss his company’s performance in 2015 and the growing interest in VRF technology in the region. He also shares his insights on the climate action plan the UAE has submitted to the United Nations for COP21 and the continued search for alternative refrigerants for high-ambient countries.

How would you assess Daikin’s performance in the Middle East market in 2015? Was it affected by the drop in oil prices?

Ryouji Sanou, President of Daikin Middle East and Africa

We entered the market here a bit later than our competitors, which is why we are well focused on improving our internal structure and furthering our market penetration. But compared to 2014, our sales in 2015 did register an almost double-digit growth.

While we can’t really say that the situation with the oil prices has had an impact on our growth, we are noticing project delays as well as experiencing a market with low cash flow. Also, the project cycle is quite long, so the true impact on the industry will take time to become apparent. But we are taking measures to avoid surprises. For example, we are tracking payments more closely and carefully looking at what projects to pursue, what areas to prioritise.

And the problem is not limited to the oil prices. There’s also the political situation in Iraq, Syria and some African countries. But we are still in a strong position in the UAE, which is one of our priority markets in the region. There is a lot of infrastructure planning being done because of the coming Expo 2020 and quite a good number of residential projects are in the works.

Other markets we’re focusing on – and they are markets we believe won’t be as affected by the oil-price situation as the rest – are Qatar and Kuwait.

In Qatar, we anticipate growth in the mega projects segment because of the [2022] FIFA World Cup. In fact, we are already involved in a big project. We are supplying a stadium with a 3,000 TR chiller system, along with fan coils.

What can we expect from Daikin in 2016?

We’re going to use more inverter technology in our products, and the focus will be on real efficiency, not just full-load efficiency.

We maintain a constant link between product development and the market. Just to give you an example, in 2015 we introduced to the GCC [region] around 15 new products. There’s always a new product that we intend to put on the market.

We’ve also opened our Technology and Innovation Centre (TIC) in Japan. It’s a big institution that approaches R&D from a different perspective by having universities, academics and other industries working together to reach even higher levels in energy efficiency and thermal comfort. A lot of investment and efforts are being done in that direction.

We were the first in the world to invent VRV, but we believe that having more competition means more marketing for the system

The industry appears to be anticipating an increase in demand for VRF technology, with more manufacturers including VRF systems in their product line-up for the Middle East. How do you see this trend affecting your market position?

We welcome the idea of having more manufacturers developing and producing VRF – or, as we call it, VRV – systems. We were the first in the world to invent VRV, but we believe that having more competition means more marketing for the system. More marketing will mean greater awareness, and a more aware market will be more receptive to the product. When the market is more receptive, we will have a bigger chance at getting to the projects.

What would you say are the factors behind the growing interest in the region in VRF technology?

In Japan, where it was invented around 35 years ago, we have already come so far in achieving energy efficiency through the use of inverter systems. So inverter systems, as well as the focus on part-load performance, will definitely spread to more markets.

The more that people become aware of the benefits of the VRV system, the more they use it. And the benefits are for the user, particularly in terms of comfort. Indoor temperature is stable and always close to the set-point – and power is used only when needed. So you have the perfect comfort with the lowest possible cost of energy, with the flexibility of installation in buildings.

The initial cost of VRF is generally higher than that of other cooling solutions, which can be a challenge in a market that is largely CAPEX- oriented. Is there any possibility of Daikin and other manufacturers eventually lowering the cost of VRF?

Speaking only for Daikin, we are about developing technology and maintaining product quality, and that’s why we are not considering reducing our prices.

Also, expensive is a relative term. On a landed-cost or installed-cost basis, for example, if you compare VRV with a chiller system, the costs could be equivalent, but over the operation, the payback [for VRV] could come quicker. So, it’s all about the total cost of ownership. VRV has one of the lowest, and the price of the product itself is comparative to those of other systems.

How suitable are VRF systems for retrofitting projects?

Compared to what were available 10 years ago, products today are more energy-efficient and offer bigger savings, and that is what we are trying to show clients and end-users.

We are definitely looking into the retrofit market. The opportunity here is to come with a full system that’s high in energy efficiency and easy to install on existing buildings – you won’t need big piping. The installation could definitely be done much easier, and VRV has been considered in many projects, like in Dubai government buildings, to replace old rooftop and ducted split units.

What type of construction or development project would benefit the most from VRF technology?

Schools would, for one, because in a school you don’t have the rooms operating all day, every day. To give you an example: A school may have a section used by the teachers while the students are not there, which means you only need to run one part of the building, not the full building. In that scenario, if you use VRV, you will only be consuming energy enough to run that part of the building. You don’t have to run the whole place just so a few zones are cooled. Hotels, too. They have different occupancy rates, meaning you don’t have to run your full system for the entire hotel if the occupancy rate is not at 100%.

It’s about looking at the use of the application, at the building load. The benefit doesn’t only come from the fact that it’s a VRV system. It also comes from the fact that you are moving from an air conditioner that can only do on and off – it runs, stops, runs and stops again – to one that continuously changes its speed to adapt to the demand. That is why inverter – having started in VRV systems – is now coming into wall-mounted units, into ducted splits and into chillers, as well. Variable speed is the future of air conditioning.

How about affordable housing? How cost-effective would VRF systems be as a solution for affordable housing projects?

Affordable housing is a relative term. More importantly, in this part of the world, effective cooling is what’s required in homes, whether affordable or not. It’s a basic requirement here, and not a luxury, so when considering VRV, of course, one doesn’t start by looking at the cost but at its suitability.

We don’t propose VRV every time. We have a very good line-up of wall-mounted, ducted splits, rooftops and chillers. As for the difference in cost, it’s the same case with anything you buy. When you go to a shop, you don’t go to buy the lowest-priced item. You probably have some connection with an item or you’re looking for something specific. It’s the same thing in air conditioning. And what we’ve observed is that people, after using VRV or inverter technology in cooling, they cannot go back to conventional systems because they’ve seen the benefits. It’s not just about energy efficiency and the cost; the comfort level is higher.

Furthermore, units today have functions and features that make them suitable for those in need of affordable cooling. Our new ‘Intelligent Eye’, for example. If no one is in the room, the set-point automatically goes higher, which means the unit does not consume the same amount of energy as it would if people were in the room. CAPEX will always be a consideration, but we feel our clients are more interested in how much a system is going to cost them over a long period.

Furthermore, units today have functions and features that make them suitable for those in need of affordable cooling. Our new ‘Intelligent Eye’, for example. If no one is in the room, the set-point automatically goes higher, which means the unit does not consume the same amount of energy as it would if people were in the room. CAPEX will always be a consideration, but we feel our clients are more interested in how much a system is going to cost them over a long period.

And there are other aspects that come into play, as well. There’s flexibility, like I said, and zoning, but again, we don’t go and propose VRV systems to everyone. We see what the problem or requirement is, and work with the consultant to identify what is the best solution, and VRV could be one of them. It’s not the only one all the time.

The UAE, as indicated in the INDCs (Intended Nationally Determined Contributions) it submitted for COP21, has expressed its commitment to applying stringent energy-efficiency regulations for appliances like air conditioning units. In fact, ESMA introduced new standards back in November. What is Daikin’s position on the UAE’s move towards stricter standards? In your opinion, is the HVAC industry ready to comply?

Daikin is recognised as a top global brand, because we produce both the products and the refrigerants, and because we are able to comply with energy-efficiency regulations. We also make it a point to introduce products that suit the region’s high-ambient conditions. It’s part of our strategy to have early compliance with the new regulations. We recently released an announcement of all our products that are compliant with ESMA. However, we see many regulations being proposed and passed, and we are taking efforts to try and unify these regulations, even if just in the UAE. We think it will benefit all stakeholders to have only one set of regulations to meet, instead of having several.

There is no perfect option, because there is no perfect refrigerant

With regard to the industry and whether or not it’s ready – well, compliance will certainly be a challenge, because you have energy-efficiency requirements on one hand and refrigerant changes on the other. But we believe these regulations are following global trends, and that the HVAC industry in this part of the world is mature enough to follow regulations and meet energy-performance levels. However, there’s a lack of awareness, especially among consultants and contractors, of these new regulations. This results in a delay between the time the regulation is legislated and the time it is implemented or adopted. This is very important to those who do try to comply, because lack of awareness means non-compliance, which means two different products on the market – the compliant and the non-compliant.

But we have heard that market surveillance is now being carried out to track the products being sold, to make sure that they are meeting set regulations.

The UAE makes no mention of refrigerants in its INDCs, but other countries like Japan do. Do you see the government in the UAE, and in the other Middle East nations, eventually establishing a definitive position on refrigerants?

Japan has been addressing the issue of refrigerants for several years now. It is basically leading the market, with other countries following it.

As for the governments here in the Middle East, they are very much aware of the situation, of global warming, climate change and the depletion of the ozone layer. Right now, they are complying with the Montreal Protocol, but at the same time, they are looking at alternatives that are suitable for the region. They don’t want to go quickly with an alternative before really making sure that they are stepping in the right direction, with a product that can meet local ambient conditions.

There have been a number of conferences and discussions on refrigerants for high-ambient countries, but so far, no consensus has been reached among manufacturers. Why do you think that is the case?

It’s true that to an external observer of those meetings, it would seem that many options are always being discussed. But it’s important to note that there is no perfect option, because there is no perfect refrigerant. A compromise must be made, so we look at economic and efficiency factors, as well as safety, of course.

Having said that, I think it’s also important to understand that in those meetings, the options get narrowed down, even though there might not be one single option in the end. Also, all those conferences focus on tests that compare the different options available. At the AHR Expo held recently in Florida, for instance, in one of the main side- events, a comparison was made on the performance of the different refrigerants that are suggested to local manufacturers today, which have been narrowed down to HFOs, R32 and R290. A lot of tests are happening, comparing those alternatives to models using R42 and R410A, with the aim of finding the best one to use for the future. Everything’s still in the research phase, but in the advanced stages.

Speaking of R32, last year, you launched the region’s first R32 system. Could you describe the response that it has, so far, received from the market?

It would be difficult to make an assessment after only a few months, because switching to a new refrigerant takes time. It would be very difficult to make a sudden change. And there’s still the need to educate the market.

Moreover, the refrigerant is never the priority of people buying air conditioners. They first look at energy efficiency and other benefits. Our product is a combination of the refrigerant, R32, and inverter technology. It is so efficient that it is being considered in many projects that aim to reduce overall consumption in large sectors.

The reaction to the refrigerant itself, however, is something we can’t comment on, because no one regards it as the highlight of your product. The highlight is the consumption versus the cooling output. But then again, with the COP21 agreement and ozone-depleting substances already being controlled, we believe that more attention will be paid to the global warming potential (GWP) of refrigerants and a strong move will be made to limit the use of those with high GWP. As we heard in the last Montreal Protocol Meeting of the Parties held in Dubai last year, HFCs could be included in the list of substances to be limited in terms of emissions. That’s where R32 can come in. It can be one of the answers to the search for low-GWP refrigerants.

Some experts are saying that if we really want to be successful in our efforts against climate change and global warming, we ought to look at natural refrigerants. What is Daikin’s position on natural refrigerants?

As I mentioned, the options are being narrowed down, and CO2 was actually among the first options evaluated. It did not, however, meet the criteria for daily residential and commercial use. In terms of emissions, yes, it’s perfect since it’s a natural refrigerant. It sets the benchmark, but in terms of energy efficiency and pressure values needed to develop an optimum machine that end-users can afford to buy, it would not be an ideal choice.

Copyright © 2006-2025 - CPI Industry. All rights reserved.