VRF, IAQ equipment prospects bright in bleak Middle East HVAC market, says BSRIA in this report it shared with Climate Control Middle East

The year 2019 was a good one in the Middle Eastern countries, with many large projects delivered, but the beginning of 2020 has seen a reduction in projects, mainly due to the economic uncertainties related to the decreasing oil revenue. In addition, the COVID-19 pandemic massively reduced income from tourism and transit trade as well as from local consumption. The Middle East BACS (Building Automation and Control Systems) market is expected to feel the impact and fall by 19% in 2020, more than the global average, and is not expected to return to 2019 sales level before 2024, but much depends on the developments in oil prices.

The UAE has seen sales of BACS products decrease by 22% in 2020, mainly affecting field devices and controllers while sales of software experienced a less significant decline. The market is expected to show moderate growth in 2021, followed by a further improvement in 2022 and 2023, but overall, the data points to a slow recovery. Retrofit and refurbishment is going to be important over the next couple of years with occupiers upgrading their buildings and installing software and products to make the buildings safer, monitoring occupancy and reducing cost by being more energy efficient and increasing remote access to building service equipment.

The market in Saudi Arabia for BACS is expected to decline by 17% in 2020, and the biggest impact is anticipated in sales of field devices, followed by controllers. The forecast is for a slow recovery with moderate yearly increase over the forecast period, reaching 2019 sales level in 2024. Hospitality and retail were severely affected by COVID-19, with most projects being delayed or cancelled and several large religious projects put on hold. However, there is currently big demand in healthcare, mainly from hospitals.

There are many projects in the pipeline, such as hospitality, transport, including airports, and warehousing as well as ambitious plans to build several smart cities, but start dates remain uncertain.

AC MARKET PERFORMANCE

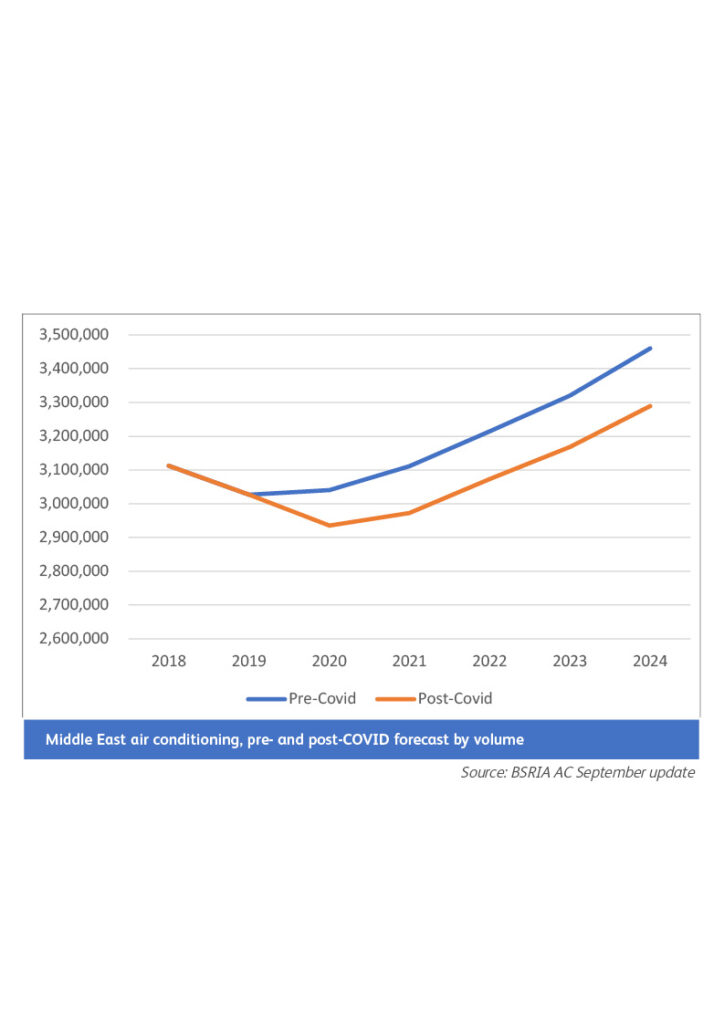

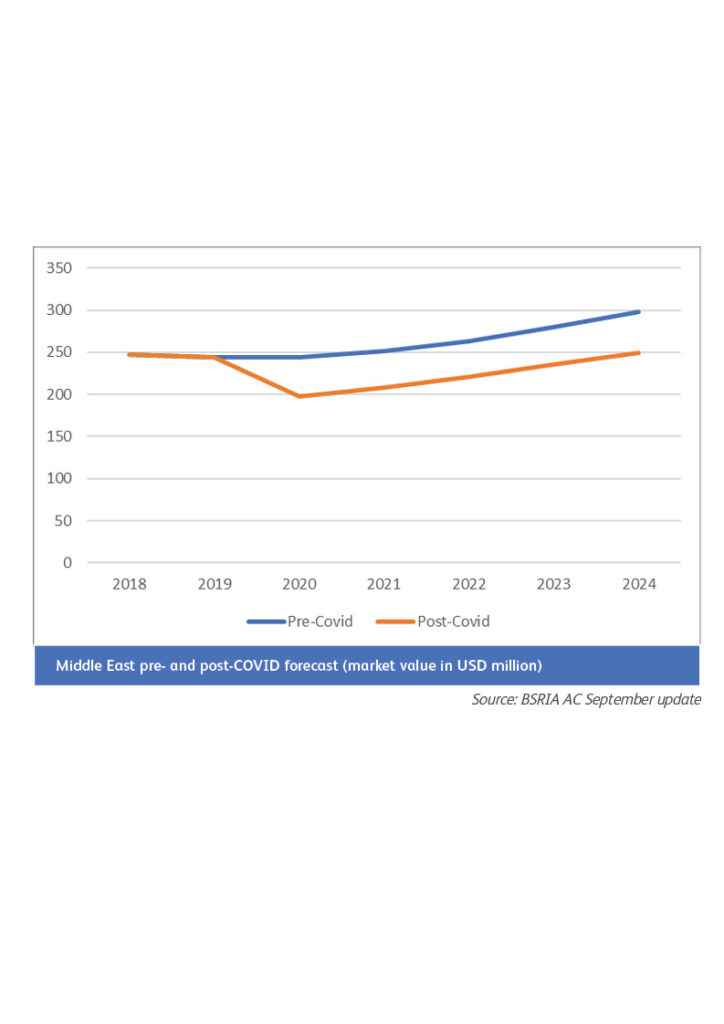

The major AC markets in the Middle East: Saudi Arabia, UAE, Iran, Oman, Kuwait and Qatar had been impacted negatively from the pandemic. The biggest two AC market data was updated by BSRIA in September to assess the first half of the year and update its forecast up to 2024.

The Saudi air conditioning market is expected to decline by five per cent in 2020, compared to previous year’s expectations of one per cent contraction in volume terms. The contraction was deeper in the chiller market compared to splits systems, which was partly down to people buying air conditioning before the VAT rate increased from five per cent to 15% in July this year. The performance in the chiller market varied by compressor, depending on the available projects and the competition; VRFs continue to erode the scroll chiller projects.

In the UAE, the first half of 2020 has seen as much as a 50% drop in air conditioning sales during the lockdown. With the easing of the lockdown, the market started picking up, and BSRIA expects the full year to contract by 10% in volume terms. In the country, replacement of ducted splits with mini VRF (<20kW) in villa projects continues, as VRFs offer much quicker and easier installation compared to ducted split systems. The price of VRFs has been coming down, making them more affordable.

Just like everywhere else around the world, the recent health crisis triggered by the pandemic has brought the debate on IAQ from the HVAC industry in the Middle East, too. The claim that a badly designed ventilation system in a public space could facilitate the viral contagion among the occupiers, has caused anxiety among the general public and sparked a renewed interest in IAQ facility upgrades engaging building owners as well as operators. The urgency of enhancing the IAQ solutions prompted by the health risk associated with the COVID-19 spread represents a challenge for regulators and specifiers, a cost for building owners and an opportunity of product development for the HVAC manufacturers.

Some of the strategies that are considered are redesigning lay-outs, zonal HVAC controls, dilution ventilation, VRF with DOAS (100% fresh air), cleaning of air ducts, filtration, ultraviolet germicidal irradiation (UVGI), smart sensors and smart controls. Utilisation of some of these strategies will depend on cost, time and knowledge from the building owners, service and maintenance contractors and building services engineers.

The consequences of this transformation on the HVAC industry are still hazy. Ventilation and air conditioning companies are developing new solutions and working in partnership with control suppliers, specifiers and regulators, specially, to resolve the apparent incongruity between efficiency and IAQ. The process is in its infancy and is confined to the geographical context of the developed countries. Nevertheless, it is clear the trend will continue even when the COVID-19 emergency is finally tamed. This trend will refocus the attention of the specifiers of commercial buildings widening their concept of sustainability in construction from a restricted reference to efficiency confined to cost and carbon emission containment to a wider target, which includes health, wellness and productivity.

CPI Industry accepts no liability for the views or opinions expressed in this column, or for the consequences of any actions taken on the basis of the information provided here.

Copyright © 2006-2025 - CPI Industry. All rights reserved.