Company’s CEO says the announced divestitures of its R&LC HVAC and Air Distribution Technologies businesses, representing roughly 20% of sales, marked a pivotal milestone in its transformation into a pure-play provider of comprehensive solutions for commercial buildings

CORK, Ireland, 31 July 2024: Johnson Controls International (JCI) has reported fiscal third quarter 2024 GAAP earnings per share (EPS) of USD 1.45, excluding special items, adjusted EPS was USD 1.14. Making the announcement through a Press Release, JCI said sales in the quarter of USD 7.2 billion increased one per cent over the prior year and three per cent organically. GAAP net income was USD 975 million, and adjusted net income was USD 769 million, JCI said.

George Oliver, Chairman and CEO, JCI, said: “Our third quarter results exceeded expectations with robust margin expansion, strong free cash flow generation, and continued Service demand.

“We have increased our backlog to record levels, building on our strong momentum driving profitable growth. We have also tightened our full year adjusted EPS guidance to reflect our progress and confidence in Johnson Controls’ prospects for continued growth and value creation. The announced divestitures of our R&LC HVAC and Air Distribution Technologies businesses, representing roughly 20% of sales, marked a pivotal milestone in our transformation into a pure-play provider of comprehensive solutions for commercial buildings and is a significant step to unlock value for our shareholders.”

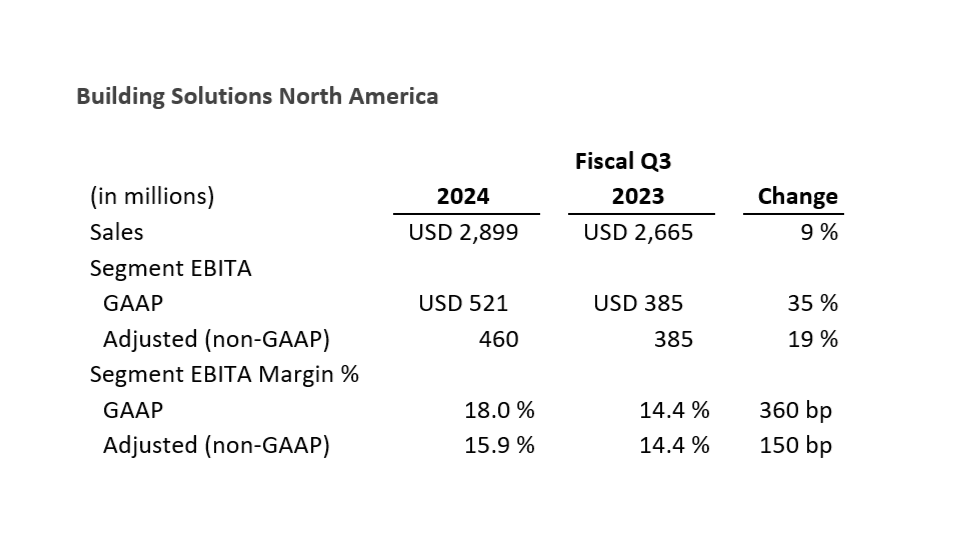

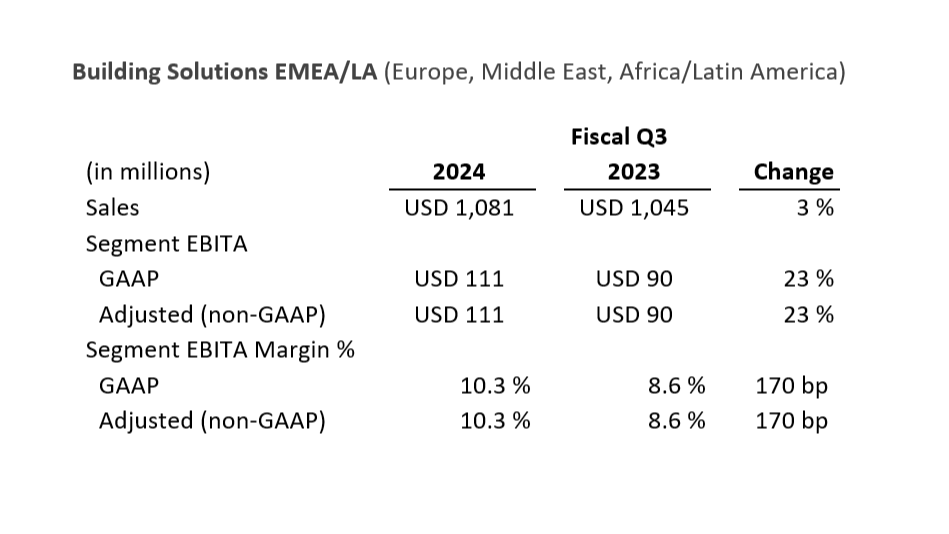

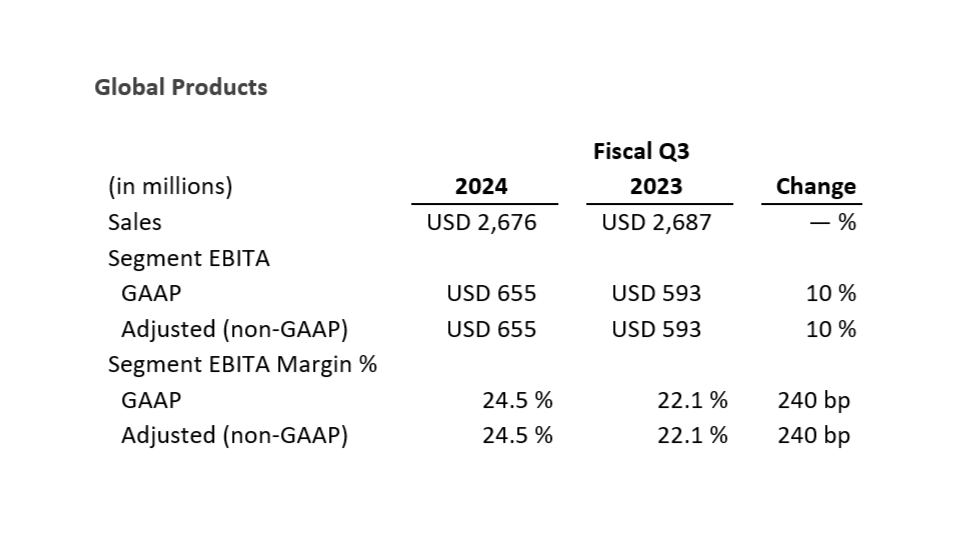

FISCAL Q3 SEGMENT RESULTS

According to JCI, the financial highlights – presented in the tables, below – are in accordance with GAAP. Unless indicated otherwise, all comparisons are to the fiscal third quarter of 2023, the company said.

Adjusted Corporate expense in Q3 2024 and Q3 2023 exclude certain transaction/separation costs.

OTHER Q3 ITEMS

According to Johnson Controls:

Copyright © 2006-2025 - CPI Industry. All rights reserved.