While it is heartwarming to see consolidation in the district cooling industry, there is quite a bit of ground that needs to be covered in terms of adopting new technologies and practices, says George Berbari

After more than 23 years of district cooling as a service utility in the GCC region, the industry is taking solid steps towards maturity and consolidation but is wobbling towards innovation and game-changing development.

With more than five million tons of installed cooling capacity, district cooling is affecting more lives in the GCC region, varying from a coverage rate of as low as one per cent in Kuwait and Bahrain to as high as 20% in Dubai alone in the UAE; overall, though, it remains below 10% for the entire GCC region.

I would love to see an increase in penetration, but can the industry coverage rate grow to 50% with current approaches and practices? As a keen representative of the industry, I do not see that happening, unless there is a serious change at the highest level in government planning to propel the various GCC region countries towards that goal.

In the years between 2005 and 2018, we have seen more development by government and private entities investing in district cooling than by providers of utility services. Lately, we have seen the trend of government entities adopting more sound financial policies, resulting in district cooling asset sales to established regional utilities, and in a strong appetite by international firms to acquire these assets in the GCC region.

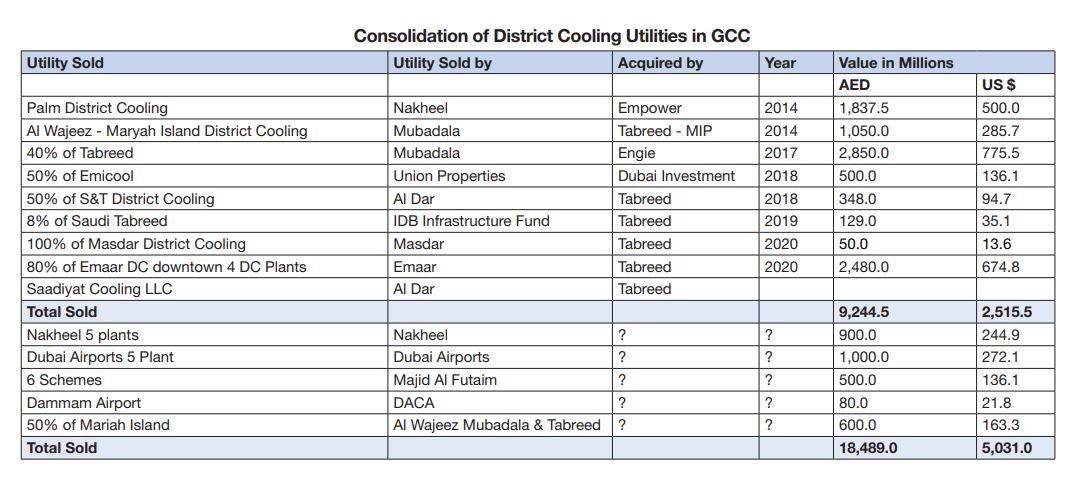

Today, established utilities, such as Empower, Tabreed, Emicool and Pal, hold more than 60% of the district cooling assets in the GCC region, and that trend is expected to grow – international players based in China, Japan, Singapore, France and other countries are likely to join the GCC region district cooling service providers. We have seen asset sales in excess of USD 2.7 billion in the past six years, which I must add is a phenomenal number. Listed below are the details: In the pipeline is an estimated 10 deals worth an estimated USD 1.2 billion, which reportedly are likely to be finalised in the upcoming two years.

While the deals – concluded and waiting conclusion – are nothing short of astonishing, the same cannot be said about the technological progress. Indeed, on the technology front, we have seen little development in the industry; with a few exceptions, it is a curious blend of mature technology, stagnation and happiness with the status quo. Chillers manufacturers are continuing to improve efficiency, which is in the range starting from 0.65 to 0.6 kW/ton.

And we are benefitting from new, more environmentally friendly refrigerants, HFO R1234ze and R1234yf, which come with the promise of a substantially lower global warming potential. We are also seeing chiller compressors with variable speed drives, which offer up to 30% energy saving during milder weather periods.

Equally exciting, a new Artificial intelligence and machine learning software is emerging, with the promise of 10-15 % energy savings in relation to overall plant usage. However, the main players are still slow in testing and adopting these technologies, owing to concerns over their effectiveness and the required time and investment.

Hand in hand with the need for adopting new technologies is the need for integrating solar PV power generation with thermal storage and the move towards carbon-neutral cities. It is the responsibility of federal and local governments to trigger the move and to push through a concrete plan towards carbon neutrality. Of course, we are witness to new developments taking shape in Saudi Arabia – the likes of Red Sea, Amaala and Neom – which have been designated as carbon-neutral; however, the adoption of air[1]cooled district cooling systems in some of the developments may not be the best technology of choice.

George Berbari

In my view, producing Green Hydrogen, through using solar and wind, may be the future main income for the GCC region countries. And early adaptation in district cooling using fuel cells with heat recovery may enhance these futureproof technologies. One visionary service provider has commenced a feasibility study on this, and it is my fond hope that we will see these technologies seeping into the district cooling industry before the end of the decade.

An equally attractive proposition is geothermal energy. How wonderful it would be to consider shallow geothermal (less than 20 metres in depth) for heat rejection! It has already started to get some attention, with small-scale adaptation happening in some small projects, which in turn, will benefit the knowledge-bank of water temperature, salinity and ground hydraulic behavior in terms of drawing or injecting ground water.

Again, it is my fond hope that we will see a partial large-scale adaptation of shallow geothermal in the industry in the next few years. I am likewise keen on large-scale deep geothermal (around 2.5 kilometres in depth). Such a project is being planned in Abu Dhabi, where ground temperatures higher than 95 degrees C can be utilised with a combination of absorption and adsorption chillers and thermal storage to produce a base load cooling of around 2,000 tons; I can’t wait to see its imminent implementation in due course of time.

Broadly speaking, though, there is much that needs to be done to adopt new technologies. As the popular saying goes, ‘A few swallows does not a summer make’. I would like to see vigour in adopting new practices, as well. Utilities, by and large, are still using unfavourable electricity and water rates for industries in most countries and emirates, except in Abu Dhabi; and it is negatively impacting district cooling rates, as evidenced by concerns raised by customers and end users.

The GCC region countries need to redesign their utility rates to enable efficient district cooling and centralised water-cooled air conditioning systems and to help improve the image of the industry from an end-users’ perspective.

Abu Dhabi, Bahrain, Dubai, Saudi Arabia and Qatar have developed or are developing district cooling standards. How wonderful it would be if they would simultaneously undertake the standardising of service contracts, which would protect the interests of end-users!

As for the utilities, they perhaps ought to take a close look at their idle capacities. Current estimates place idle capacity at 1.5 million tons in the GCC region. A likely solution would be to create a neutral piping distribution entity, which would extend the network to a concentration zone in cities and interlink them, whenever and wherever it is technically and financially feasible to do so. This model would improve the business coverage of district cooling utility providers through full capacity utilisation and economy of scale; and that way, they would be able to offer more competitive pricing on one side and reduce contracted capacity closer to actual peak.

In summary, the district cooling industry is mature, profitable and has the ability to attract large foreign investment. However, utility providers need to accelerate their technological development and focus on customer service, particularly in relation to competitive pricing.

It would be interesting to see GCC region governments evolving an integrated energy strategy, where district cooling would cover at least 90% of their major cities. And I am talking of a model of district cooling that would integrate renewable energy, hydrogen production, co-generation and thermal cooling energy storage as a base for future carbon-neutral economies, which in turn, rely on the export of hydrogen rather than oil.

George Berbari is CEO, DC PRO Engineering and Author, The Energy Budget. He may be reached at gberbari@dcproeng.com.

Copyright © 2006-2025 - CPI Industry. All rights reserved.